Decentralized Identity (DID) & Self‑Sovereign Identity (SSI): The Future of Digital Trust

1. Introduction to Decentralized Identity (DID) & SSI

Digital ecosystems are rapidly evolving, but trust remains fragmented. Traditional identity systems are siloed and centralized, exposing users to data breaches, privacy violations, and identity theft. This challenge is amplified as Web3, digital banking, and cross‑border commerce accelerate.

Decentralized Identity (DID) and Self‑Sovereign Identity (SSI) aim to solve this by returning control of digital identities to individuals. Rather than relying on central authorities, users own, manage, and share their credentials directly, verified via blockchain technology and cryptography.

At KKRF, we see DID and SSI as the backbone of next‑generation digital trust frameworks—vital for industries like banking, healthcare, government, and retail.

2. Why Digital Trust is Evolving

Key drivers pushing the shift from centralized to decentralized identity models include:

- Centralized Failures: Data breaches (Equifax, Aadhaar leaks) have exposed billions of identities.

- Regulatory Pressure: Laws like GDPR, CCPA, and India’s DPDP Act mandate privacy and consent.

- Cross‑Border Interoperability: Businesses need seamless verification across regions and platforms.

- Web3 & Blockchain Growth: SSI aligns naturally with decentralized apps, tokenized ecosystems, and digital wallets.

3. Core Concepts & Components of SSI

Decentralized Identifiers (DIDs)

- Unique blockchain‑anchored identifiers replacing usernames or email IDs.

- Controlled by individuals, not organizations.

Verifiable Credentials (VCs)

- Digital attestations (e.g., driver’s license, diploma) cryptographically signed by issuers.

- Instantly verifiable without calling back to the issuer.

Identity Wallets

- Mobile or web applications where users store and manage credentials.

- Provide selective disclosure (share only what’s needed).

Trust Frameworks

- Protocols ensuring interoperability between issuers, holders, and verifiers across ecosystems.

4. Global Market Overview & Growth Projections

The DID/SSI market is witnessing explosive growth due to Web3, fintech innovation, and government digital ID programs.

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | $2B |

| 2025 | $5B |

| 2027 | $18B |

| 2030 | $40B |

| 2034 | $1 Trillion |

Growth Drivers:

- Banking & fintech demand for compliant, low‑friction KYC.

- Government push for national e‑ID programs (India, EU, Singapore).

- Consumer demand for privacy‑preserving digital services.

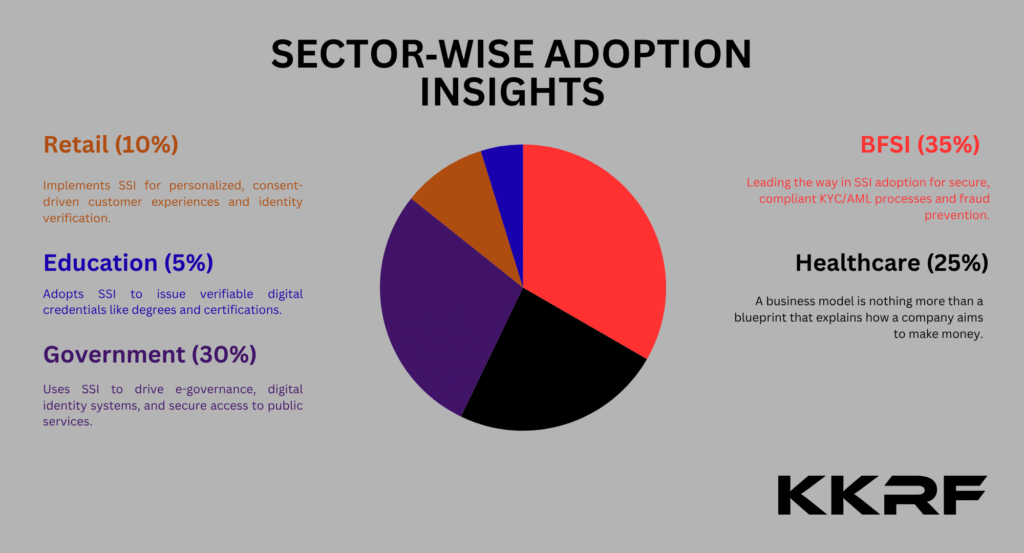

5. Sector‑Wise Adoption Insights

- BFSI: Leading adoption due to AML/KYC compliance and fraud reduction.

- Healthcare: Protecting patient data and enabling secure cross‑provider sharing.

- Government: Powering e‑governance and public services.

6. Technology Stack Powering DID/SSI

| Layer | Technologies Used |

|---|---|

| Blockchain Layer | Hyperledger Indy, Ethereum, Polygon |

| Identity Framework | W3C DIDs, Verifiable Credentials |

| Wallet Applications | Mobile Identity Wallets (iOS/Android) |

| Security Layer | Zero‑Knowledge Proofs (ZKP), PKI |

| Integration Layer | APIs for ERP, CRM, Web3 dApps |

Our modular stack integrates blockchain frameworks enabling scalable, interoperable SSI solutions adaptable to enterprise and government use cases.

7. Regional Market Trends & Opportunities

Asia‑Pacific

- Fastest‑growing region, driven by India’s Aadhaar evolution, Singapore’s GovTech initiatives, and China’s digital yuan ecosystem.

- SSI adoption expected to surpass $200B by 2030 in APAC alone.

Europe

- Regulatory leader with eIDAS 2.0 and GDPR‑aligned SSI frameworks.

- EU Digital Identity Wallet set to drive pan‑European adoption.

North America

- Enterprise‑led growth in BFSI and healthcare.

- Investments by major players like Microsoft Entra and IBM Verified ID.

8. Benefits & Challenges of SSI Implementation

Benefits

- Full User Control: Individuals manage their own credentials.

- Privacy & Compliance: Meets evolving data protection regulations.

- Fraud Reduction: Verifiable credentials cut down on identity theft.

- Cost Efficiency: Reduces repetitive KYC/AML checks for enterprises.

- Interoperability: Works across platforms, geographies, and ecosystems.

Challenges

- Regulatory Fragmentation: Different countries, different rules.

- Interoperability Gaps: Multiple blockchain standards.

- User Adoption Curve: Educating end‑users on wallets and consent flows.

9. Future Outlook: DID & SSI in Web3 and Beyond

- Metaverse Identity: Single DID for avatars across multiple virtual worlds.

- IoT & Edge Devices: SSI for secure machine‑to‑machine authentication.

- AI Integration: AI agents managing identities autonomously on behalf of users.

- Cross‑Chain SSI Solutions: Interoperable identities across multiple blockchain interoperability ecosystems.

10. KKRF’s Expertise & Value Proposition

KKRF leverages 70+ technology stacks, certified cybersecurity capabilities, and enterprise blockchain experience to deliver end‑to‑end SSI solutions.

Why KKRF?

- Proven Projects: $2.5M Indian Oil blockchain initiative.

- Certified Cybersecurity Leader: Licensed provider in India.

- Multi‑Domain Expertise: AI, RPA, SAP, IoT, and Web3 integrations.

- Consult‑Build‑Scale Model: Strategy → Development → Deployment → Ongoing Support.

11. Pricing & Engagement Models

- Proof of Concept (POC): $10K – $20K

- MVP Deployment: $40K – $80K

- Enterprise Roll‑Out: $80K+ (customized)

Engagement Models:

- Fixed Cost

- Time & Material

- Dedicated Development Teams

12. Timeframe for Development & Deployment

- POC: 6–8 weeks

- MVP: 3–4 months

- Enterprise Roll‑Out: 6–12 months (depending on scale and compliance)

13. FAQs on DID & SSI

Q1. What is Decentralized Identity (DID)?

A DID is a unique blockchain‑based identifier controlled by the user, enabling secure and private digital identity management.

Q2. How does Self‑Sovereign Identity differ from traditional ID systems?

SSI allows individuals to own and share their identity credentials without central authorities, unlike traditional systems which store IDs in centralized databases.

Q3. Which industries benefit most from SSI?

Banking, healthcare, government services, retail, and education benefit greatly from SSI adoption.

Q4. What technologies power SSI solutions?

Core components include blockchain (Hyperledger, Ethereum, Polygon), W3C DIDs, verifiable credentials, zero‑knowledge proofs, and mobile wallets.

Q5. How can KKRF help with SSI adoption?

KKRF offers consulting, development, deployment, and ongoing support, leveraging 70+ technology stacks and proven enterprise blockchain experience.

14. Conclusion & Next Steps

Decentralized Identity and SSI are not just technologies—they’re enablers of trust in the digital economy. From banking to healthcare to e‑governance, their impact is transformative.

KKRF stands at the forefront of this revolution, delivering secure, scalable, and future‑ready SSI solutions for enterprises and governments worldwide.

KKRF Value in One Line

“Empowering enterprises with secure, scalable, and future‑ready decentralized identity solutions.”